Combine T4s from multiple organizations into one

If you're an admin for multiple payroll organizations and all of the organizations are connected to ONE Rise account, you should combine all your T4s into one organization.

Let's say you have two organizations, Bi-Weekly Org and Semi-Monthly Org, and you want to combine both organization's T4s into Semi-Monthly Org.

1. Switch to Bi-Weekly Org.

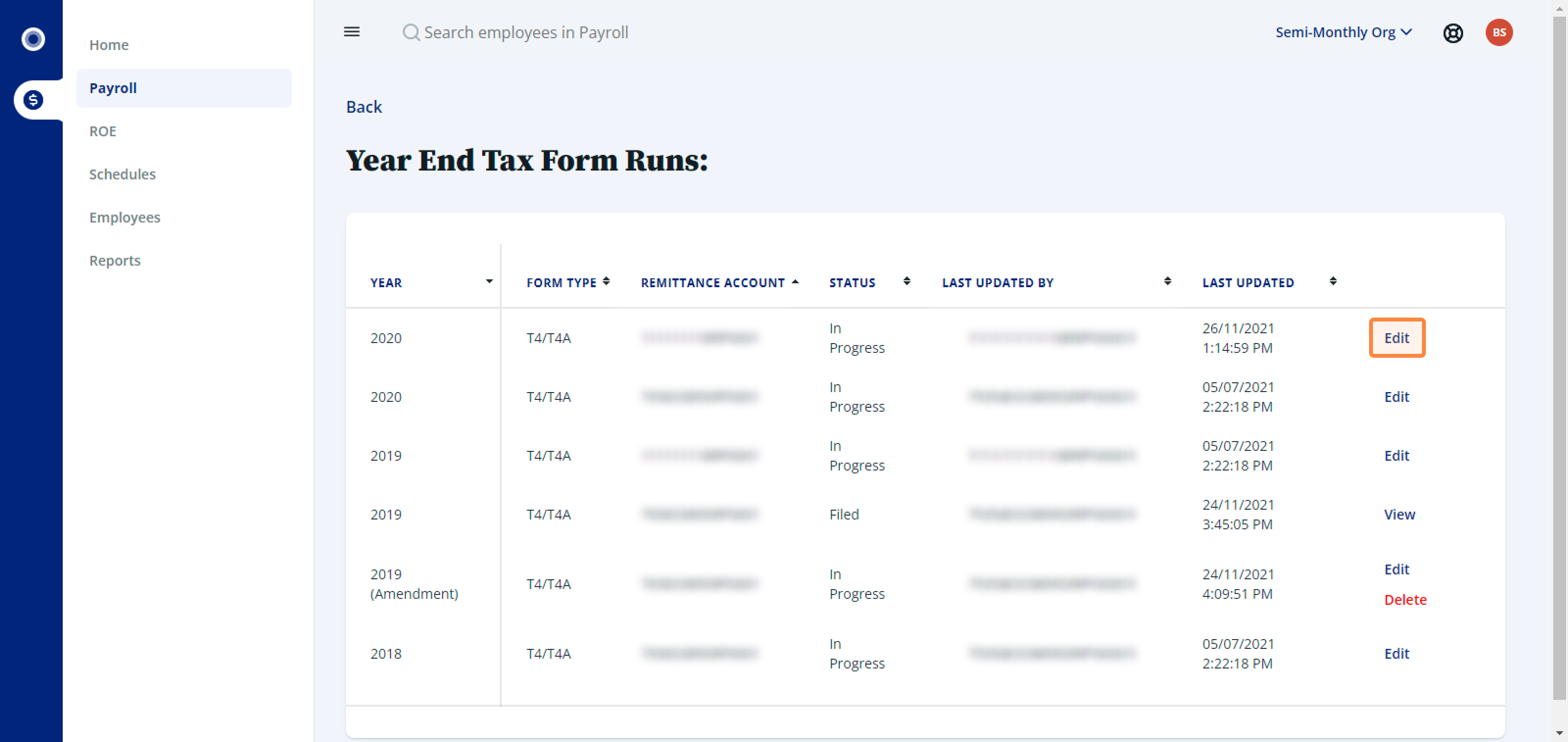

2. Navigate to Payroll, then click Tax Form Runs.

3. Find the year you wish to export from, and click Edit.

4. Click Download CSV Tax Form Data.

5. Open the downloaded CSV file and delete all data in the Employee ID row.

6. Save the CSV file and keep it open. Return to Rise and switch to Semi-Monthly Org.

7. Navigate to Payroll, then click Tax Form Runs.

8. Find the year you wish to export from, and click Edit.

9. Click Download CSV Tax Form Data.

10. Return to the Bi-Weekly Org T4 CSV file and copy all rows (except the title row). Paste all these rows into the Semi-Monthly Org CSV file beneath the bottom row, and save the Semi-Monthly Org CSV file as a new file.

11. Return to Semi-Monthly Org and click Upload CSV Tax Form Data. Import your saved Semi-Monthly Org spreadsheet.

You're done!

I get a warning about duplicate employees when I try to upload my spreadsheet.

Employees cannot have duplicate entries. If an employee was in both organizations throughout the year, their T4 data will need to be combined into one line.

I get a warning about duplicate Employee codes when I try to upload my spreadsheet.

If the same employee code is being used for multiple employees, simply create a new (fake) employee code for one of them. The employee code does not need to match the profile and does not appear anywhere on the T4 itself.

Related Articles

Process tax form runs

Prior to processing year end tax forms, you must complete the following steps: 1. Close the previous year. For details on how to close the previous year, check out our article on How to close the year. 2. Find your T4 remittance balance from the CRA. ...Send one-off finalized tax form to an employee

Once you complete your year end in Rise Payroll, you can send employees' tax forms to their work email. Only previous year’s tax forms and current year’s finalized tax forms can be sent. 1. Navigate to Payroll and click the Employees tab. 2. Here ...Amend tax forms

1. Navigate to Payroll, then, under Payroll, click Tax Form Runs. 2. Click Amend beside the year you want to amend. Make sure the original tax form run is filed with the CRA, or you won’t be able to amend. If you amend RL-1 Tax Form, a new line with ...Payroll Reports overview

Understanding your payroll data is a key part of running a smooth business. This guide will walk you through how to access the most important reports in Rise, helping you get the information you need quickly and with confidence. Payroll Register ...Close the payroll tax year & update remittance settings

Closing the payroll year is a mandatory step you must complete in Rise. This process finalizes all your payroll data for the current year and allows you to start processing payroll for the next tax year with updated government rates and frequencies. ...