Generate the Temporary 10% Wage Subsidy report

To view and generate the 10% Temporary Wage Subsidy Report, follow the below steps:

1. Select Reports from the side menu and click on Custom Reports.

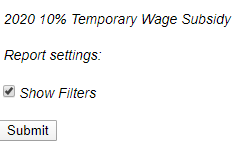

2. Under Payroll Reports, select 2020 10% Temporary Wage Subsidy report.

3. 2020 10% Temporary Wage Subsidy report uses Pay Runs with Pay Dates between the prescribed date range for the Temporary Wage Subsidy (March 18 to June 19 2020). Click Submit to generate this report.

4. Here you will see two tabs. The Employee Subsidy tab displays all the employees who have been paid in the qualifying pay runs (Pay Date between Mar 18 2020 and Jun 19 2020).

5. The columns in the Employee Subsidy tab can be interpreted as follows:

Column | Description |

Organization Name | the name of the current organization |

Business Number | the business number the employee was paid under. Some organizations have more than one in a single organization |

Pay Run | the combined values for Pay Year, Pay Run Number, and Adhoc Pay Run Identifier (if applicable) |

Pay Date | the date at which the employees get paid |

Pay Run Status | the status of the pay run being reported on |

Employee Name | the combined values of first name and last name |

Employee Code | the code for this employee |

Remuneration Amount | the gross amount paid to the employee in this pay run |

Subsidy Amount | Remuneration Amount * 10%, Amount round to 3 decimals |

Capped Subsidy Amount | the lesser of the Subsidy Amount or the per Employee maximum of $1,375 for the Temporary Wage Subsidy program, Amount round to 3 decimals |

Accumulated Subsidy Amount | accumulates the employees Capped Subsidy Amounts up to the maximum of $1,375, Amount round to 3 decimals |

6. The Total Subsidy by Business Number tab shows the total subsidy available and the current total of the remittance adjustments created.

7. The columns in the Total Subsidy by Business Number tab can be interpreted as follows:

Column | Description |

Business Number | The business number(s) for the organization |

Total Subsidy Available | The total calculated subsidy available to the business number for the posted pay runs at the date the report was run. It is capped at $25,000 per business number. |

Total Subsidy Remittance Adjustments | If the organization opted into the automated calculation of the remittance adjustments this number will reflect the amount of the remittance adjustment currently made. The number may be less than the Total Subsidy Available based on when the organization opted in and the amount of Federal Tax that was available to withhold from remitting. |

Related Articles

Generate the 75% Canada Emergency Wage Subsidy (CEWS) report

Before following the steps in this article, ensure that you've read the Government of Canada's latest updates on the Canada Emergency Wage Subsidy program. Your eligibility may have changed. The Government of Canada continues to support Canadians ...Custom Payroll reports overview

Opening a custom report Select Reports on the side menu and choose the Custom Reports tab. Click on any custom report to view or edit. Exporting a custom report to Excel 1. Once you open your report, adjust your filters and press Submit. The filters ...Generate Client Sales Tax Rate report

A new Client Sales Tax Report has been added to the Payroll Custom Provider Reports. This report shows the sales tax rate. To view and download this report, follow the below steps: 1. Sign into your payroll account and click Reports ? Custom ...Generate important Payroll reports

How to download Payroll Register Reports 1. Navigate to Payroll, then click on the Reports tab. 2. Under the Standard Reports tab, you’ll find the payroll register report under the Payroll Reports section, click on Payroll Register. 3. Select the ...Create a Gross Earnings report

1. Select Reports on the side menu, click on the Custom Reports tab, and then select Pay Runs (under Payroll Reports). 2. Filter your report to the specific date range or pay period you would like to view, then press Submit. 3. Select Layout and ...