Sync key payroll dates to your calendar app

To help keep track of important dates, you can use calendar feeds to connect your personal calendar with Rise. Dates will be automatically added to your calendar and will be updated if any changes are made.

If you're looking to add time off calendars to your personal calendar, here's an article on how to do just that.

To add a calendar feed to your personal calendar:

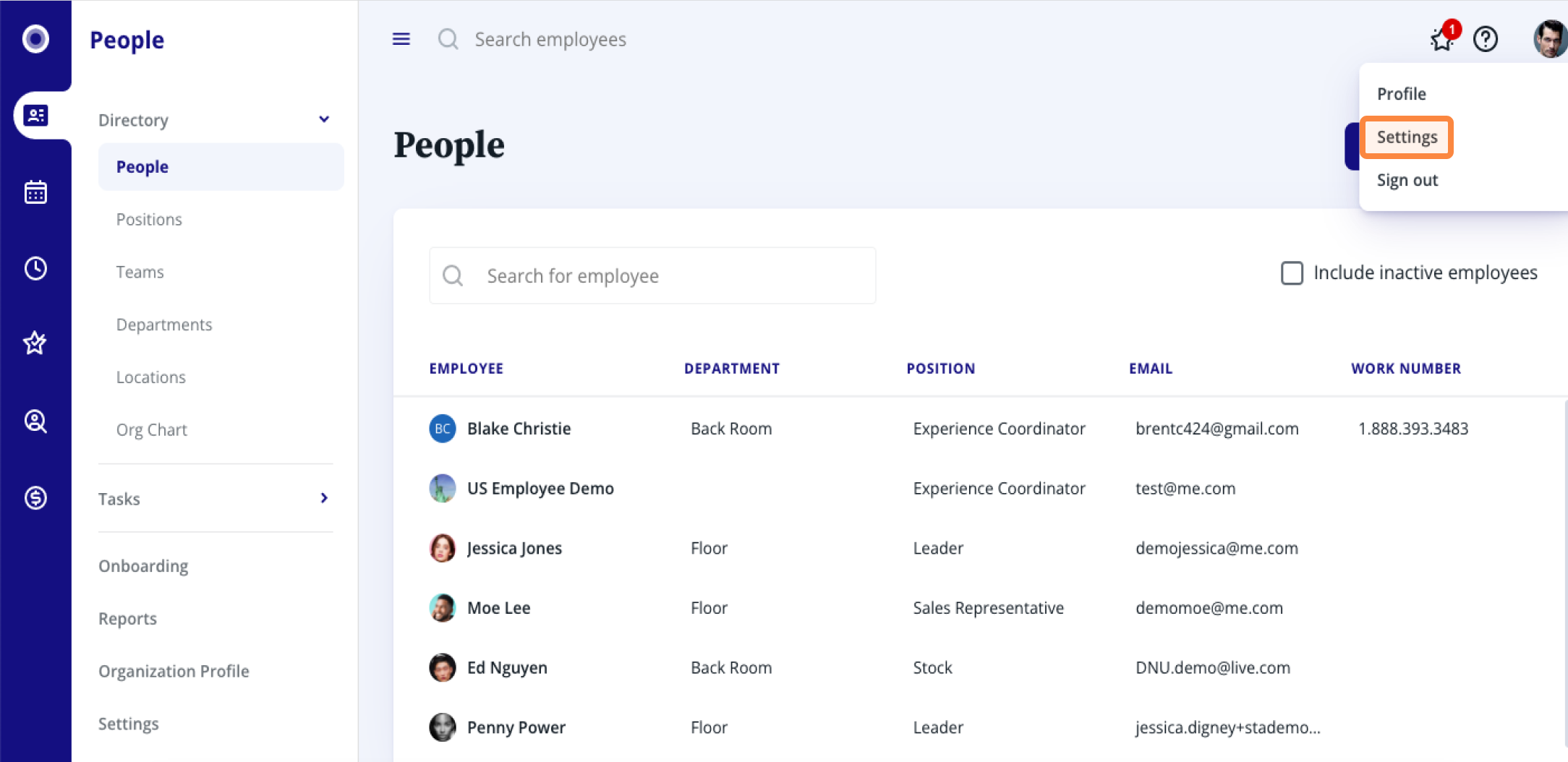

1. Click your profile icon in the upper right corner, then click Settings.

2. On the Settings page, click Calendar feeds.

2. On the Settings page, click Calendar feeds.

3. Find the calendar feed you want to add to your calendar, then click Copy URL.

Once you’ve copied the calendar feed URL, you’ll need to add it to your personal calendar. The process will be different depending on which calendar application you use, but we’ve included instructions for a few common calendar apps below.

Organizations that have not implemented single sign-on (SSO) don't have the calendar feeds feature available. For example, if you use one set of credentials to access Rise HR and another for Rise Payroll, you aren't able to use calendar feeds just yet.

Related Articles

Payroll setup overview

Before you start processing your first payroll with Rise, please ensure you do the following: 1. If you have previously used a different provider, please inform Service Canada of your intent to change payroll providers by issuing a single Record of ...Change an ad-hoc payroll pay date

Determining an appropriate pay date When you create an ad-hoc pay run, you specify the pay date. Just like your regular payroll, Rise needs three banking days to process ad-hoc pay runs. If you approve the pay run on Monday before 10am PST the ...FAQ: Payroll setup

Q: How does Rise calculate deductions for federal and provincial taxes? A: Rise uses cumulative averaging, meaning that our system uses the year-to-date options in the tax calculation as described in the Payroll Deductions Formulas for Computer ...Payroll Reports overview

Understanding your payroll data is a key part of running a smooth business. This guide will walk you through how to access the most important reports in Rise, helping you get the information you need quickly and with confidence. Payroll Register ...Add payroll instructions to the input sheet

Adding an instruction to the input sheet If a payroll instruction is not scheduled to appear on this run (or potentially not scheduled to appear on any run by default, as is the case with "occasional" payroll instructions) it will be available to add ...