Custom Payroll reports overview

Opening a custom report

Select Reports on the side menu and choose the Custom Reports tab. Click on any custom report to view or edit.

Exporting a custom report to Excel

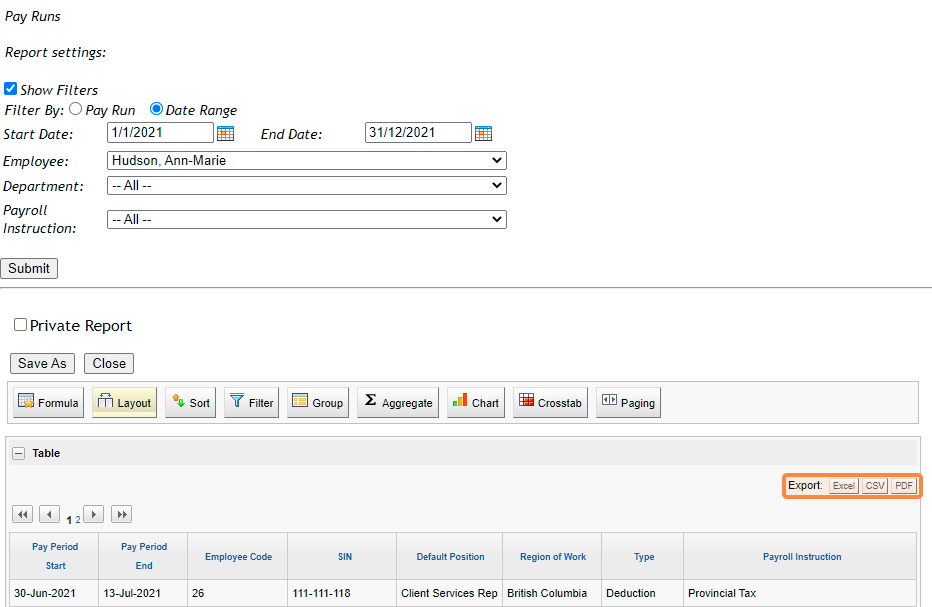

1. Once you open your report, adjust your filters and press Submit. The filters available will vary per report.

2. Click Excel, CSV, or PDF on the top right of the report to export.

Report functions

The buttons at the top of each report are called reporting functions. For more information about these functions and what they can do, check out our article on What are these reporting functions.

Saving a Custom Report to Saved Reports

Related Articles

Standard Payroll reports overview

Departmental Payroll Register This report breaks down your register entries into department sections. Each department will have a departmental total, and the report shows a company total at the bottom. You can export this report to a pdf. Employee ...

Generate important Payroll reports

How to download Payroll Register Reports 1. Navigate to Payroll, then click on the Reports tab. 2. Under the Standard Reports tab, you’ll find the payroll register report under the Payroll Reports section, click on Payroll Register. 3. Select the ...

Payroll reporting functions overview

How to customize a Custom Report Custom reports provide a large amount of information, and there are functions provided to help narrow down the report to just the data required. We highly recommend using the functions available to make the ...

Create a Gross Earnings report

1. Select Reports on the side menu, click on the Custom Reports tab, and then select Pay Runs (under Payroll Reports). 2. Filter your report to the specific date range or pay period you would like to view, then press Submit. 3. Select Layout and ...

FAQ: Payroll setup

Q: How does Rise calculate deductions for federal and provincial taxes? A: Rise uses cumulative averaging, meaning that our system uses the year-to-date options in the tax calculation as described in the Payroll Deductions Formulas for Computer ...